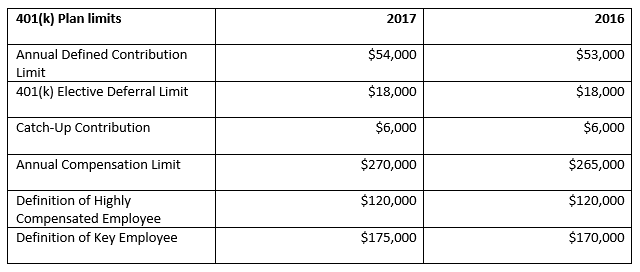

It’s that time of year again where limits for 401(k) plan contributions are released by the IRS. Because the cost of living index did not rise by much, the limits, for the most part, have remained unchanged. We put together a comparison of 2016 and 2017 to show which limits have increased. More details can be found in Notice 2016-62.

In general, the amounts that employees can contribute remained at their 2016 limits while the maximum limit for all sources (deferral, match, employer contributions) have increased by $1,000 to $54,000. Other increases are seen in the annual compensation limit as well as the compensation amount for determining a key employee.

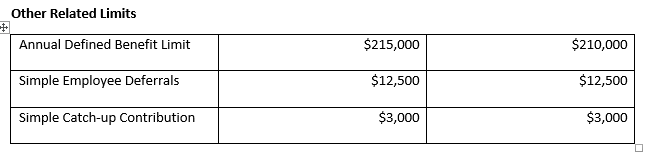

Beyond 401(k) plans, the defined benefit limit was increased by $5,000 to $215,000.

Join the conversation

We would love to hear from you