Oversight of investment fees remains one of the most important duties retirement plan sponsors must perform in order to fulfill their fiduciary duties. This responsibility is spelled out in ERISA law. “Reasonable compensation” to service providers is permitted, as long as the work they perform is done with the best interests of plan participants in mind. Therefore plan sponsors should pay careful attention to share classes in their plan.

(See our ERISA white paper for a more in-depth discussion on the relevant parts of the code for plan sponsors.)

The majority of class action lawsuits filed against plan fiduciaries in recent years have been focused on excessive fees and the failure of fiduciaries to ensure the lowest cost fund options are available to participants in plan lineups. Quite often, these alleged breaches of fiduciary duty come down to decisions over which fund share class to offer to participants.

Why Funds Offer Different Share Classes

Fund providers offer different share classes of certain funds as part of a distribution and sales strategy for their chosen target markets. In many instances, offering multiple share classes creates different ways for investors to gain entrance to the same fund. The only difference between share classes is on the fees they charge.

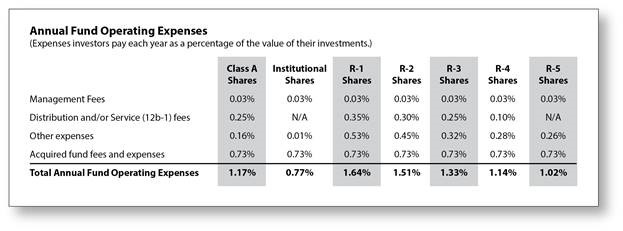

Here’s an example of the differences in share classes for a target date fund (see table below). The Annual Fund Operating Expenses table (a required element in all fund prospectuses) compares by share class what expenses investors will be charged on a percentage basis. As you can see, some expenses are consistent (in this example, the 0.03% management fee is the same across all share classes); but other fees vary among different share classes.

Let’s focus on one of these expenses—distribution and/or service fees, more commonly known as 12b-1 fees and Sub-Transfer Agency Fees (Sub-TA Fees). The 12b-1 fees are typically charged to fund investors and participants to pay to third-party providers (e.g. brokers) for services related to selling or marketing the fund and Sub-TA Fees paid by the fund for maintenance of account records and execution of trades.

These types of “revenue sharing” agreements are common and legal. From a plan sponsor and fiduciary duty perspective, it is hard to know what services these revenue sharing agreements cover—if these fees are in fact reasonable and if the services provided are in the best interests of plan participants. This opens the door to a possible breach of fiduciary problems.

Zeroing Out Revenue Sharing

In the chart above, notice how the Institutional and R5 share classes do not charge the 12b-1 fees. In these cases, these share classes are “zero revenue share” funds, where plan participants pay only for management fees and other expenses related to fund operations.

The differences between the Institutional and R5 shares are typically the amount of money invested that can be in each. Institutional share classes often come with a minimum investment requirement, usually at $1,000,000 or more, while the R5 share class comes either with no minimum investment requirement or a very small one.

Similar “zero revenue share” fund share classes are expected to gain in popularity as the Department of Labor’s new fiduciary rules take effect.

Are You Meeting Your Fiduciary Duty?

There are two important steps plan sponsors can take as part of their fiduciary responsibilities to help ensure they meet their duties to monitor for excessive fund fees.

First, plan sponsors should explore different share class options for funds that are included in their plan’s lineup or are under consideration. Knowing the different share classes the plan is eligible for can help plan fiduciaries ensure the lowest-cost option is being offered to participants, or at least has been considered.

Second, document the process for reviewing, selecting and monitoring funds chosen for the investment lineup. A written record of each evaluation that includes a comparison of fund expenses among available share classes demonstrates a process of prudence important in fiduciary oversight and ensuring that participants’ best interests are protected.

Join the conversation

We would love to hear from you